The basic principles of money management

Before you can become a successful trader or investor, you need to know the basics of money management. Meaning, you first need to get your personal finances on track. If you don’t have any insights into your personal finances, trading and investing will be very emotional driven and you will most likely fail.

Reading time: 11-15 minutes (2.810 words)

Key concepts this chapter:

- You always have to pay taxes, start paying yourself first.

- Boost your financial morale and start saving.

- Don't spend money on things you don't need.

- Make your housing a profitable investment.

- Ensure a future income.

- Guard your treasures from loss (insurance).

- Start to invest in yourself.

- Good luck is created.

- Take action!

The principles we'll discuss are thousands of years old. The same principles that worked thousands of years ago still work to this date. All these principles are mentioned in the book “The Richest Man in Babylon”. This book follows a few people on a journey to wealth while living in the biggest city in the world 4000 years ago: Babylon. These principles can save you from bankruptcy or making bad financial decisions. Trading and investing is not about your IQ but knowing what you are doing and sticking to your plan. If you have no financial plan you will fail. These principles will help you to get the right financial mindset. After reading this chapter I highly recommend you buy this book. It’s a great story and the principles and examples will last a lifetime. There is a link to buy this book at the bottom of the page.

1. One tenth of all you earn is yours to keep

One tenth of all the money you earn is yours to keep. This means you should always save 10% and don't spend this money. Even if you are in debt, you should pay yourself first. This way you always have money for emergencies. Knowing that you have money even if you are in debt boosts your financial morale. Most creditors are willing to make a special payment construction if you are serious about it. This way you can pay off creditors and save money at the same time.

What other entity in the following list is paying itself first?

Reward: +10 XP 0 0 0

Let's say you earn $2500 each month after taxes. For the next year, the government decides that you only have to pay taxes at the end of the year. Instead of earning $2500 you now get $3000 each month. But you have to save $500 each month to be able to pay the tax collection at the end of the year. Many people can't handle this mindset and start spending the extra $500 a month sooner or later. You can imagine that saving $6000 (12 * $500) of taxes a year can be a daunting task. Especially when you have a habit of buying things you don't need. The government knows that most people are bad at saving so they collect taxes before you get paid. They pay themself first.

You always have to pay taxes, start paying yourself first.

Action to take:

No matter how much money you earn, always save 10% and never touch this money unless it’s absolutely necessary. You don’t have to do this forever. A rule of thumb is to save at least your monthly expenses times six.

2. Start thy purse to fattening

Once you have the habit of paying yourself first, you can see your bank account growing. This has two big benefits:

- You get the motivation to earn/save more money

- You get a financial peace of mind

Knowing that you can always pay yourself first no matter what will give you a big boost in morale. Many people live from paycheck to paycheck. By the end of the month, all the money they earned is already spent. By the time you retire you have no money left and are dependent on your pension or other government safety nets. Imagine (depending on your current age) you are saving 10% of all the money you earn for the next ten years? If you earn $2500 each month and save 10% you will have $30.000 in ten years.

Your mindset might limit your thinking:

"I can't save 10% each month..."

It's actually easier to save 10% than to earn 10% more. In most cases, people spend too much money on things they want instead of need. Ditch the wants and your bank account will grow.

3. Control thy expenditures

Controlling your expenditures is key for a happy financial life. Many people think they need to earn more money. The truth is, money management has nothing to do with how much money you earn but has everything to do with how much money you spend. That’s why people with big incomes can be in a financially bad position while other people with much lower incomes can have perfectly balanced financials. There are many examples of athletes who made millions but lost all their money once they stopped earning money. They still spend millions but have zero income. That will end up badly sooner or later. Without a plan to control your expenditures you will eventually end up like everyone else:

- Living paycheck by paycheck

- In debt almost your entire life

- Hardly have any savings

- Buying things you don't need (keeping up with the Joneses)

- Working till you are old

- 100% dependent on government safety nets when you retire

One way to achieve a balanced and healthy financial environment is not spending money on things you don’t need. Don’t let yourself go when your neighbour buy’s a new car. It’s not a race to decide who has the most expensive car, biggest house or fastest smartphone. You have no idea how your neighbour is handling his or her finances. Most people think that all people living in the same neighbourhood have the same income. Which is not true at all. Some people look "rich" but are actually very poor because they spend all their money.

On what subject do you think average people spend more money on than an average millionaire?

Reward: +10 XP 0 0 0

Did you know most millionaires live in standard neighbourhoods? Did you know most millionaires do not spend their money? That’s why they are millionaires in the first place. Just think about it for a little bit. How can you be a millionaire if you spend all your money? How millionaires live and how they spend money is pretty interesting and the outcome might suprise you. If you are interested in how millionaires live and what you can learn from that livestyle you should definitely read "The millionaire next door". There is a link to buy this book at the bottom of the page.

“To earn one million, you must spend one million less”

So many people are living in expensive houses (mortgages), have too many cars and all they do is work their ass off all day every day and notice that their wallet is empty at the end of each month. What can you do to avoid this:

- Live below your standard

- Stay out of debt as much as possible

- Don’t confuse things you want with things you need

- Don't raise your standards if you earn more money

- Create multiple income sources beside your day job

- Invest your money instead of spending it

If you start living based on your income then you are completely dependent on this income. If for some reason you lose your job/income you'll have big problems. Especially if you did not follow the “pay yourself first” principle. That does not mean you can't spend money on things you want. Pay yourself 10% of your income first. Everything else that is left you can spend or invest. You can also make some more drastic decisions. Like ditching the second car and take the bike to work (if possible). This does not only save you a lot of money, you're also working on your health at the same time.

4. Make of thy dwelling a profitable investment

Make your housing a profitable investment. Own your house. Pay your mortgage as quickly as possible. Don’t just buy a home, look for the best environment to live in. This is not only a financial choice but also a choice for your health. Living in a big city is not good for your health. Besides that, houses are much cheaper in small villages. If you buy your house carefully you can decide to bike to your work instead of using the car. Also, don’t buy a house you can't afford or don’t need. Everyone wants a big house. And most of the time people can hardly afford it. They have to take multiple jobs just to pay off the mortgage. From the outside they might look "rich" but in reality, these people are struggling to pay their bills each month. Choose your house carefully as this will probably be the biggest "investment" you will ever make in your lifetime.

To summarize:

- Own your house, don't take a maximum mortgage

- Don't only look at the house, find the perfect environment

- In general, living in a small town is better for your health versus a large city

- Housing prices are cheaper in smaller towns vs a large city

- Take the bike to work if possible

5. Make thy gold multiply

Now you know how to make your bank account grow. To summarize:

- Live below your standard

- Don’t buy things you don’t need

- Pay yourself first

- Invest your money

If you live like this, the only expected outcome is that you will accumulate more money. Your bank account will grow. If you are beyond the point of paying yourself first (monthly expenses times six), you can start investing the money you earn to make even more money.

What would be the cheapest way to invest but has potentially the most value?

Reward: +10 XP 0 0 0

6. Ensure a future income

Your future begins now. The younger you start to apply the basic principles of money management the more benefits you will get later in life. Many people are dependent on safety nets from the government when they retire. This is not necessarily a bad thing but the fact is that someone else is in charge of your finances. You need to have a plan for the future:

- How do you want to live when you retire?

- At what age do you want to retire?

- Do you want to be dependent on government and politics? Or do you want full control over your finances?

- You want to be a millionaire?

- Or live in mediocrity like everybody else?

Thinking about it this way ensures you make the right decisions. The decisions you make today will determine your future. The sooner you start the more benefits you will reap.

7. Guard thy treasures from loss

Sometimes things can happen to you can’t predict. That’s why insurance exists. Always ensure that you are guarding your treasures from loss.

- Are you insured when your house burns down?

- Are you insured when you get sick or lose your job?

- Are you insured when you lose all your money in a bad trade?

- Did you seek professional help or read books before doing any investments?

You need to guard your treasures from loss. You are the only one who can make a wrong decision when it comes to trading or investments. Many times people blame the external environment or other people for the bad things that can happen in life:

- "That guy was lucky when he started his website at the right time"

- "I don't have the genetics to be muscular"

- "Someone gave me bad advice"

- "I'll never be rich or get out of debt"

It's not someone else's fault if you make a bad financial decision. The biggest enemy you will encounter when trading or investing is you. Guard your investments from loss by protecting them from yourself. For most people, it's best to not trade or invest at all or very minimal using zero effort approaches.

8. Increase thy ability to earn

Start to invest in yourself. Knowledge is power. You can teach yourself new things. This can also mean you can switch jobs or start an online career next to your current day job. It’s never too late to learn. Most people have to work so hard every day of the week they have no time and energy left for other things. Hundreds of millions of people turn on the TV after work. Now there are some shows out there that actually teach you some things. But overall TV is just for entertainment. That doesn’t mean you can never watch TV again. Just spend your time wisely and try to learn new things. This will hugely improve your ability to earn.

Besides, if you want to learn how to trade or invest successfully, you need to spend hundreds or even thousands of hours. What if you have a forty hour workweek? Do you even have time to learn new things? Many people are addicted to Netflix or playing video games. Claiming they don't have time. Increase your ability to earn and ditch all things you don't need in your life. You can watch Netflix or play video games after you learned something new. If you watch Netflix or play video games first, you will most likely never find the drive to learn something new.

Action to take:

If you want to become an successful investor or trader (making consistent profits) you need to learn a lot. There is no other way. Unless you want to lose all your money. Start planning your journey and be prepared to spend a lot of time. You are already off with a good start since you are reading this guide!

9. Men of action are favored by the Goddess of Good Luck

What would best describe luck?

Reward: +10 XP 0 0 0

You can create your own luck by starting to take action. This is fueled by the law of nature:

"For every action, there is an equal and opposite reaction."

The more time you spend on taking action the universe will react to it. This is inevitable because it’s a law of nature. But don’t be fooled. This also works the other way around. You can take action by blindly putting money in your investment account and just buy random stocks. But you might have an idea how that might turn out… Focus on taking the right actions and progress and the Goddess of good luck will eventually find you.

10. Take action!

Now is the time to take some time and look at your personal finances. Is there something you can change? The key here is to take action (if needed). Don't just hop to the next chapter. Think about all the things you've read on this page and take action accordingly. This is very important because you simply can't use money for trading or investing if you need this money in the near future.

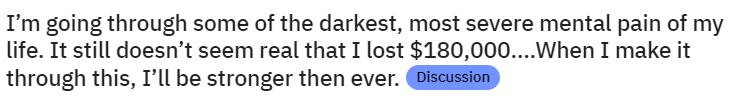

What might happen if you don't follow these rules?

https://www.reddit.com/r/terraluna/comments/uqo6f8/im_going_through_some_of_the_darkest_most_severe/

https://www.reddit.com/r/terraluna/comments/un40h4/my_excolleague_attempted_suicide/

Terra Luna is (or was) a cryptocurrency trading around $86 of may 5 2022. On the 13th of may 2022, Luna is trading for $0.00003. Without going into details, Terra Luna experienced an attack which caused the coin to lose value and literally became worthless.

This is not really a problem if you invested money you can afford to lose. It’s a huge problem if you invested your entire life savings in Terra Luna. You might think that most people know to not put all their life savings in any investment ever. But till this day, many people still do. It’s heartbreaking to read the above reddit threads about people that lost all their life savings and seeing suicide the only way out.

Also, giving “advice” to family or friends should be avoided at all costs. Even though you have your personal finances on track, that does not mean everybody follows the same rules. Even if you tell them to follow these rules. People will not hesitate to blame others for their own mistakes. That is very natural but can backfire rather quickly as the thread above shows.

Even all information and tools you can find on penketrading.com is not advice you can blindly follow. Always do your own research and only trade with money you can afford to lose.

Must reads:

Are you wondering how millionaires spend their money? It's the complete opposite of what you think. Read the complete story (based on real data) with many insights, behaviours and mindsets of millionaires:

The Millionaire Next Door: The Surprising Secrets of America's Rich

The Millionaire Next Door: The Surprising Secrets of America's Rich

View book on Amazon.comRead the whole story behind this article and use practical tips and insights to create a perfectly healthy financial mindset:

The Richest Man in Babylon: Original 1926 Edition

Learn the basic principles of personal money management

View book on Amazon.comGood job! You gained 5 XP and 0 0 5 . What's next:

- Share my article with someone you think should learn this too:

- Let me know what you think in the comments.

- Want to learn more? Click on the next article below. You gain another 5 XP and 0 0 5 .

- Join the community if you want to keep your earnings and track your progress: Join the community

Chapters: How to become Financially Independent

- 1. How to become financially independent2. How does the economy work?3. Assets and liabilities4. The most important and biggest asset in the world 5. Money management6. How to become a millionaire7. What is your goal?8. Your personal situation9. How to start investing10. Building a business11. Conclusions and what's next

Comments

How you think about this?