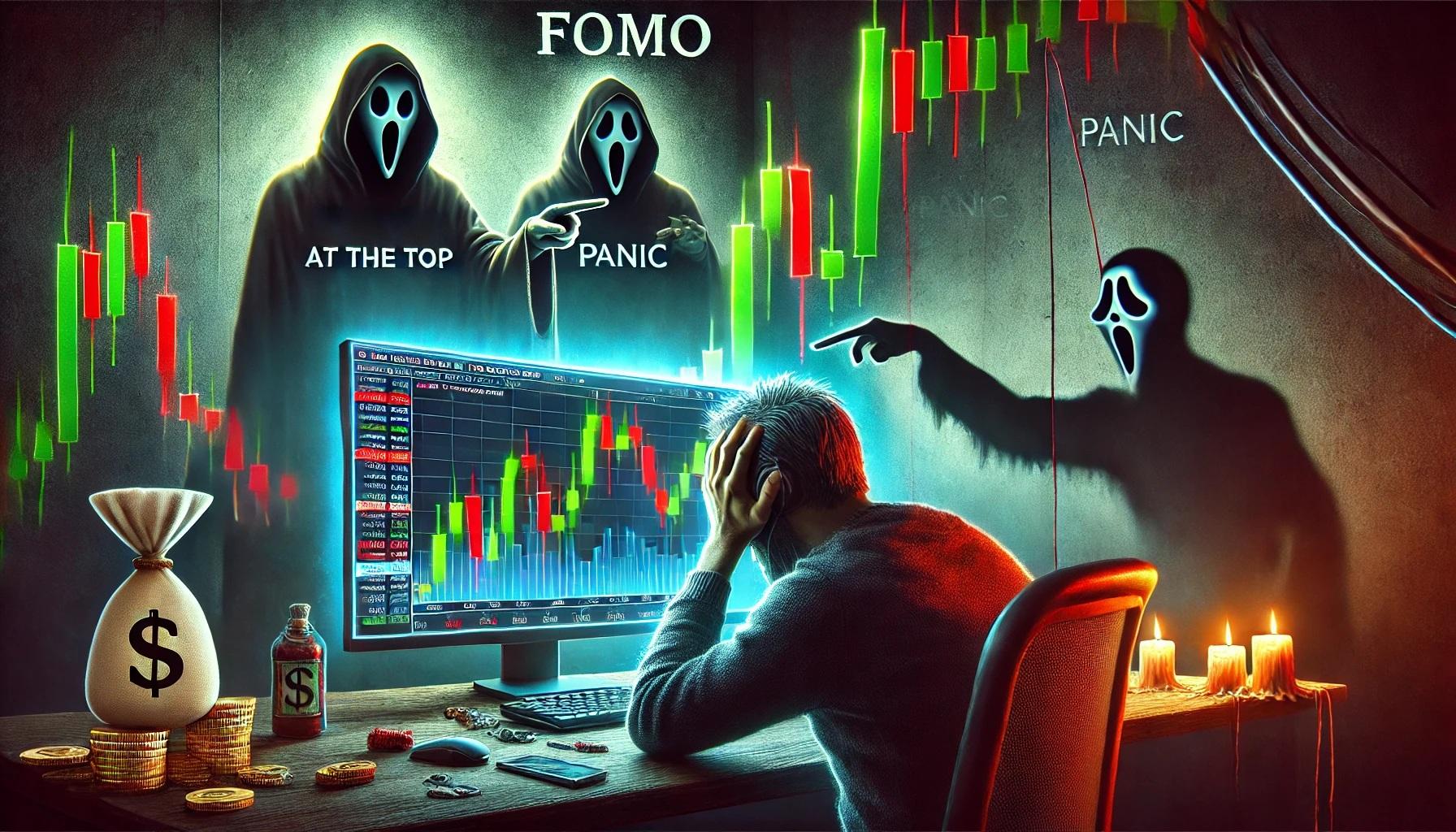

Why YOU Buy Tops & Sell Bottoms🤦♂️ (And How to STOP!)

You’ve done it. I’ve done it. Every trader has done it.

You watch price skyrocket, feel the FOMO kicking in, and before you know it, you’re clicking "BUY" at the absolute peak—just in time for a massive dump.

Or worse… You see price crashing, panic sets in, and you sell everything right before the reversal.

Why does this happen? Why do traders, including YOU, keep making this mistake?

👉 It’s not because you’re stupid. It’s not because you lack experience.

👉 It’s because your brain is wired to fail in trading—unless you break the cycle.

🧠 The Psychological Trap of Buying High & Selling Low

Markets are engineered to play with your emotions—especially fear and greed.

🔹 Greed kicks in when price pumps → You feel like you're "missing out" → You buy at the top.

🔹 Fear takes over when price dumps → You feel like it will keep crashing → You sell the bottom.

It’s not just you—this happens to every retail trader who doesn’t understand how markets truly work.

Let’s break down the psychology behind this and how you can stop falling for the same trap over and over again.

You’re watching Bitcoin or a stock pumping hard—green candle after green candle. The news is bullish, Twitter is hyped, and people are screaming "BUY NOW OR BE LEFT BEHIND!"

You feel the pressure building. If you wait, price might never come back.

🚨 What do you do?

Reward: +10 XP 0 0 25

SUPPORTERis ad-free.

SUPPORTERis ad-free.🚀 The Hidden Game: How Market Makers Exploit Retail Traders

Picture this…

You're sitting at your screen, watching price rip higher. Twitter is hyped, the news is bullish, and influencers are calling for "new all-time highs!" Your heart beats faster. You don’t want to miss out.

So, you buy.

But the moment you enter, something strange happens… The momentum stalls. A few red candles appear. “It’s just a dip,” you tell yourself. But then—BAM!—the price plunges. Your entry turns red instantly.

You panic. You didn’t expect this. "Maybe I should just sell before it gets worse?"

And right when you finally give in and hit sell, price bounces back up like magic.

What just happened?

You just got played.

🎭 The Market Maker’s Playbook

Market makers and smart money don’t buy like retail. They don’t FOMO into moves. Instead, they create moves to manipulate you into handing over liquidity.

Here’s how they do it:

1️⃣ They push price up aggressively to create hype.

2️⃣ Retail traders FOMO in, thinking it’s the “last chance” to buy.

3️⃣ Smart money starts unloading their bags on these late buyers.

5️⃣ Price tanks, trapping FOMO buyers in a loss.

And when price drops hard? Retail traders panic sell at the exact moment smart money starts buying again.

It’s a beautiful, brutal cycle.

If this sounds familiar, that’s because it happens over and over again.

Most traders never escape this trap because they trade based on emotion, not logic. But once you start seeing what’s really going on behind the scenes, you’ll never look at the market the same way again.

🚀 Ready to stop being the liquidity? Let's keep going.

You see a strong resistance level, and price is approaching it fast. Twitter is buzzing about a breakout, and retail traders are getting ready to long on the breakout candle.

🚨 What do you do?

Reward: +10 XP 0 0 25

🛠️ How to STOP Buying Tops & Selling Bottoms Forever

Imagine this…

You're at your desk. The market is moving, but you're calm. There's no rush, no panic, no urge to click the button just because price is flashing in front of you.

You see the same price action as everyone else—

🚀 The breakout happening…

📉 The pullback forming…

🔻 The dump shaking people out…

But unlike before, you’re in control.

You already know where you want to enter.

You already know at what price you'll exit.

You already know what would make you skip the trade entirely.

This is what a real trader looks like.

Let’s break it down step by step.

🧘 Step 1: Become the Calm Trader

The best traders don’t chase—they wait.

📌 They don’t react to every price move.

📌 They don’t feel the need to be in a trade all the time.

📌 They understand that missing a trade is better than forcing one.

Next time you feel the need to jump into the market ask yourself:

❓ Do I actually have an edge here, or am I just chasing price?

❓ If I don’t take this trade, am I missing a real opportunity, or just a quick rush of adrenaline?

The calm trader knows:

👉 If it’s not a clear setup, there is no trade.

📊 Step 2: Trust the Data, Not Your Feelings

A trade should never be based on emotion. It should be based on evidence.

Before entering, ask yourself:

✅ What does volume say? (Is there real demand or just hype?)

✅ What does liquidity say? (Are big players actually buying or are they offloading into retail?)

✅ What does confirmation say? (Is price actually breaking out, or is it a trap?)

A calm trader waits until price proves it’s ready.

An emotional trader jumps in first and hopes it works out.

♟️ Step 3: Position Yourself Where Smart Money Is

The market isn’t random. It’s engineered.

📌 Price doesn’t just move—it’s pushed to areas where liquidity is waiting.

📌 Smart money doesn’t buy on impulse—they buy where retail is forced to sell.

That means:

🔹 Instead of chasing price, you wait at key liquidity levels.

🔹 Instead of reacting, you already have a plan before price gets there.

🔹 Instead of guessing, you know exactly what will make you enter or skip the trade.

The best entries feel boring. You’re not rushing. You’re not second-guessing. You’re simply executing your plan.

🛡️ Step 4: Accept That Some Trades Will Get Away

Here’s the hardest truth: You don’t need to catch every move.

👉 Some breakouts will happen without you.

👉 Some trades will run without ever giving you a perfect entry.

👉 Some plays will stop you out before moving in your direction.

That’s fine.

📌 A calm trader doesn’t chase.

📌 A calm trader doesn’t revenge trade.

📌 A calm trader moves on to the next trade.

Because in the long run? Missing a trade won’t ruin you. But chasing the wrong ones will.

SUPPORTERis ad-free.

SUPPORTERis ad-free.💡 The Market Rewards the Calm, Not the Reactive

Think about the traders who consistently make money.

They aren’t the ones who click buttons out of fear or excitement.

They aren’t the ones who trade every setup just because it "looks good."

They are the ones who sit back, observe, and execute only when the market gives them the green light.

And now, that’s you.

From today forward, you are the calm trader.

No more chasing. No more reacting. No more emotional trades.

Just clear plans, smart decisions, and executing with precision.

🔥 Take Action Right Now!

💬 Know someone who NEEDS to hear this?

Every trader has that one friend who keeps jumping in at the worst time. Share this article with them.

Because real traders aren’t competing against the market—they’re competing against their own impulses.

👇 Send this to someone who needs it.

SUPPORTERis ad-free.

SUPPORTERis ad-free.Resistance Is WRONG…

So, now you’ve mastered how to stop chasing price and trade like a calm professional. But there’s one more thing you need to see…

📌 You’ve been taught that support and resistance are key levels where price reverses.

📌 You’ve been told that if price reaches support, you should buy—and if it hits resistance, you should sell.

But what if I told you… that’s all a lie?

The market doesn’t respect support & resistance—it exploits them.

👉 Ever wondered why price breaks a resistance level, only to dump right after?

👉 Why does price bounce off support just enough to trick you, then collapse?

👉 Who is actually making money from these levels—retail traders, or someone else?

I’m going to tear apart the biggest myth in trading and show you what REALLY drives price action—so you stop being the one getting played.

👇 Click here to keep reading…

📖 “Support & Resistance Are a LIE! 🚧 (Here’s What REALLY Moves Price)”

Chapters: The Psychology Behind the Price – Stop Trading on Emotion!

Comments

How you think about this?